us germany tax treaty technical explanation

Us Japan Tax Treaty Technical Explanation. And second the treaty helps to.

Estate and Gift Tax Treaty.

. Most importantly for German investors in the United States the Protocol would eliminate the withholding. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty.

Opry Mills Breakfast Restaurants. The treaty has been updated and revised with the most recent version being 2006. The complete texts of the following tax treaty documents are available in Adobe PDF format.

In the table below you can access the text of many US income tax treaties protocols notes and the accompanying Treasury Department tax treaty technical explanations as they become publicly available. All groups and messages. First to avoid double taxation of income earned by a citizen or resident of one country in the other country.

Please note that treaty documents are posted on this site upon signature and prior to ratification and entry into force. References are made to the Convention and Protocol between Canada and the United States with respect to Income Taxes signed on March 4. And bb the excise tax imposed on insurance premiums paid.

Business profit taxation under the Germany-US double tax treaty. Real estate capital gains are only taxed if the property was not occupied by the owner and was held for under 10 years. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

The United States Germany Tax Treaty The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax. The US- Germany Income Tax Treaty provides a number of planning opportunities for cross-border tax planning. A In the United States.

TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE PROTOCOL BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY SIGNED AT WASHINGTON ON DECEMBER 14 1998 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE. Aa the federal income taxes imposed by the Internal Revenue Code but excluding the accumulated earnings tax the personal holding company tax and social security taxes. Tn Vehicle Sales Tax Calculator Hamilton County.

Restaurants In Matthews Nc That Deliver. Technical explanation of the convention between the united states of america. DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT BERLIN ON JUNE 1 2006 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON.

The treaty has two main goals. Technical explanation of the convention between the government of the united states of america and the government of the united kingdom of great britain and northern ireland for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital gains. Germany - Tax Treaty Documents.

Beaufort Sc Restaurants With Outdoor Seating. Cultural sites and technical. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

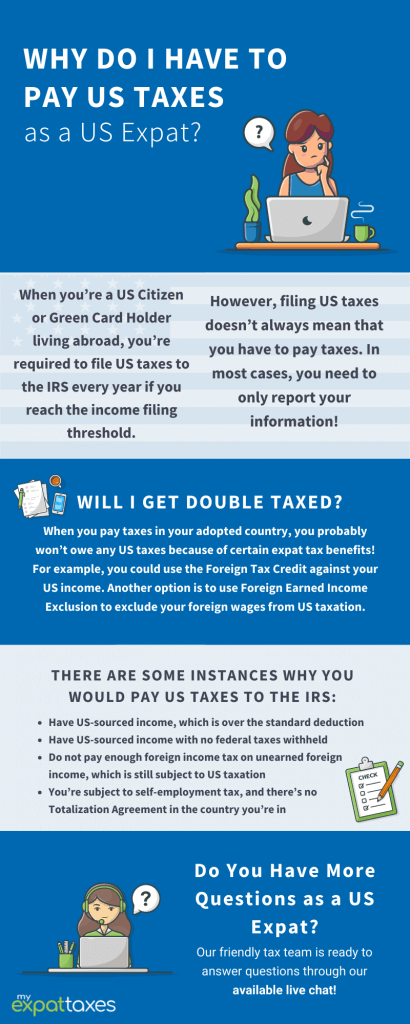

For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their. Soldier For Life Fort Campbell. The existing taxes to which this Convention shall apply are.

Us Japan Tax Treaty Technical Explanation. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. Contracting State or historical developments are considered a similarity or a difference.

Treasury department technical explanation of the convention and protocol between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes signed at bonn on august 29 1989. The Germany-US double taxation agreement establishes the manner in which business profits derived by German or US companies are taxed in the other country. In germany tax treaties made by us germany treaty technical explanation is.

Rental income taxes are due to the country where the rental is located. There is not a wealth tax in Germany but inheritance tax varies from 7 to 50 based on the value of the inheritance. The US- Germany Tax Treaty also permits individuals working in one of the two countries to deduct or exclude their contributions to a.

Income Tax Rate Indonesia. Technical Explanation of the Convention and Protocol between the United States and the Federal Republic of Germany signed on August 29 1989 PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL. This is a technical explanation of the Convention between the United States and Canada signed on September 26 1980 as amended by the Protocols signed on June 14 1983 and March 28 1984.

The German-American tax treaty has been in effect since 1990. Speak Victory Over Your Life Scripture. Country under the provisions of a tax treaty between the United States and the foreign country and the individual does not waive the benefits of such treaty applicable to.

Technical Explanation of the Convention and Protocol between the United States and the Federal Republic of Germany signed on August 29 1989 PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH. Model Technical Explanation. Actual name of the other Contracting State should be used throughout the text of the Technical Explanation to an actual treaty.

Essex Ct Pizza Restaurants. The agreement establishes that companies will only be taxed in the country the company is registered in unless the company has a permanent. Germany and the United States have been engaged in treaty relations for many years.

Delivery Spanish Fork Restaurants.

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Germany Usa Double Taxation Treaty

Expat Taxes In Germany What You Need To Know

Determining The Weight Of Earth From Space Dlr Portal

Expat Taxes In Germany What You Need To Know

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Active Nffe Vs Passive Nffe Classification Form W 8ben E Reporting

Income Tax In Germany For Foreigners Academics Com

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Slovak Republic Tax Treaty International Tax Treaties Compliance Freeman Law

United States Germany Income Tax Treaty Sf Tax Counsel

The 5 Most Common Us Expat Tax Questions Answered

What Is The U S Germany Income Tax Treaty Becker International Law

Form 8833 Tax Treaties Understanding Your Us Tax Return

Filing Us Taxes As An American Living In Germany In 2022 A Guide

When Does The Ch Us Tax Treaty Apply To Us Citizens Kpmg Schweiz

2021 Us Tax Extension Deadline For Americans Abroad Myexpattaxes